Control Cash Flows.

Boost Working Capital.

OpenCFO helps finance leaders automate and orchestrate AR, AP, and Treasury with intelligent workflows to optimize cash conversion cycle.

Meet the Agentic AI Platform that Helps Drive Working Capital Efficiency.

Use our AI agents and unified workflows to monitor, decide, and act on cash flow in real time.

Accounts Receivable

Accounts Receivable

Manage receivables with a single view across collections, cash application, and credit risk and improve liquidity management.

-

CollectionsAI agents prioritize and trigger follow-ups to accelerate payment.

-

Cash ApplicationAutomated remittance capture and payment matching to accurately close invoices.

-

Credit ManagementAI-driven real-time customer risk tracking to minimize exposure and debt.

Our Impact

Accounts Payable

Accounts Payable

Control payables with unified visibility and intelligent workflows across approvals, payments, and vendor obligations.

-

Invoice ManagementAutomated invoice capturing, 2-way & 3-way matching, and approval workflows to manage errors and efforts.

-

Payments OptimizationAgent-led optimization of payment timing and currency to ensure timely settlements and preserve liquidity.

-

Vendor ManagementCentralized access to vendor bills, receipts, & contracts for accurate records and audit readiness.

Our Impact

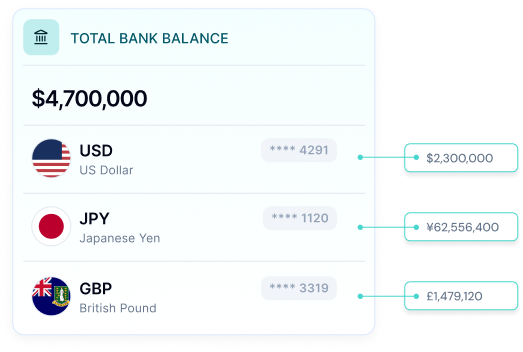

Treasury Management

Treasury Management

Gain real-time visibility, predictive insights, and control over cash movement, liquidity, and risk across the organization.

-

Cash PositioningTrack real-time cash positions across accounts, entities, regions, and currencies.

-

Liquidity & Risk MonitoringAI agents identify liquidity gaps and capital risks early to support proactive decision-making.

-

Payments & FX ExecutionManage domestic and cross-border payments with optimized FX and settlement timing.

Our Impact

Scale your business with better cash flow visibility and control.

Get Started TodayWhy High Performing Finance Teams Choose OpenCFO?

Better cash flow management changes how finance teams operate, decide, and lead. OpenCFO is built to make that shift possible.

Shorten the cash conversion cycle

Improve the cash conversion cycle with coordinated control across receivables, payables, and treasury.

More working capital availability

Free up trapped cash and make capital available without increasing risk to make decisions for growth and investment.

Faster and streamlined decisions

Act on real-time, unified data instead of delayed reports and reconciliations.

Proactive risk management

Identify liquidity risks early to make better decisions and mitigate them before impact.

Clear visibility without manual reporting

Custom dashboards replace spreadsheet-heavy reporting and constant validation.

End-to-end workflow automation

Automate AR, AP, and Treasury workflows across the existing ERP and payment systems.

Zero manual reconciliation

Eliminate data correction, matching, and cross-system cleanup.

More time for real work

Reduce operational effort so teams can focus on customers, vendors, and outcomes.

Better DSO and DPO control

Optimized collections and payouts improve timing without extra follow-ups.

Fewer exceptions and surprises

Surface issues early with continuous monitoring, reducing last-minute escalations and rework.

How it Works

OpenCFO connects to your existing systems and starts delivering insight and automation in weeks, not months.

Connect your systems

Connect your ERPs, accounting systems, and banks in minutes with zero disruption to existing workflows.

Configure automations

Set up intelligent workflows for payments, reconciliation, and reporting based on your business rules.

Optimize and grow

Watch your working capital improve as OpenCFO continuously optimizes your financial operations.

For a frictionless onboarding, engage our expertise.

We understand the complexity of financial intelligence and operations. Our customer success team ensures a seamless experience with OpenCFO.

Book a Demo

How it

works?

How it

works?

Leverage our one-of-a-kind guided onboarding experience to make sure you go live in weeks.

Who is it

for?

Who is it

for?

This is for anyone who requires our support in ensuring a smooth onboarding and custom integrations.

Connect Your Systems with OpenCFO

OpenCFO connects with all the leading ERPs and banking systems. Custom integrations are available upon request.

Get started with a free trial!

Pay only when you start seeing value from the platform.

Get Started TodayFAQs

OpenCFO targets both ends of the CCC. On the Account Receivables (AR) side, we use automated dunning and dispute resolution to reduce Days Sales Outstanding (DSO). On the Account Payables (AP) side, we optimize Days Payable Outstanding (DPO) by centralizing invoice processing and enabling strategic timing of payments, allowing you to hold cash longer while maintaining strong vendor relationships.

No. Your ERP remains the System of Record (GL, sub-ledgers). Our platform acts as the System of Intelligence and Engagement. We sit on top of your ERP to orchestrate the workflows, automate the manual touchpoints, and provide a unified view of your Net Working Capital, syncing all financial data back to the ERP in real-time.

OpenCFO automates the Dispute Management process. The system auto-codes deductions based on reason codes (e.g., pricing error, shortage) and routes them to the correct stakeholder for resolution. This reduces Write Offs and prevents valid receivables from aging out unnecessarily.

ERPs are designed to store data, not to drive action. While your ERP simply lists who owes you money, OpenCFO acts as an intelligent layer on top. We use AI to analyze behavior, not just payment dates, allowing your team to focus on the right customers at the right time. Plus, our workspace is designed to reduce clicks by 90% compared to standard ERP screens.

Since our data model is designed to sit lightly on top of your existing systems, we can typically go live in days/weeks, not months. We offer pre-built connectors for major ERPs to streamline the data ingestion process

Ready to take control of your cash flow?

Join lean finance teams moving swiftly with unified workflow-led intelligence.